Bitcoin Core 27: Initial Blockchain Sync Errors Discovered

A recent investigation into Bitcoin Core 27 has uncovered a number of bugs affecting the initial blockchain sync process. These issues, reported by several users and moderators on the r/Bitcoin subreddit, are a reminder to be careful when syncing your blockchain.

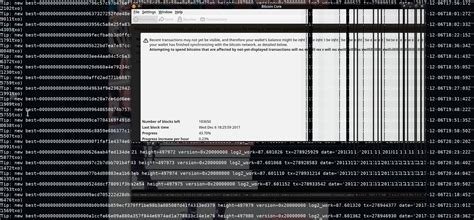

Error messages from the debug.log file indicate that there were repeated instances of the “Blockchain not found” or “Invalid transaction” error during the initial sync process. This suggests that Bitcoin Core 27 encountered problems connecting to the underlying network and validating transactions on the blockchain.

Debug Log Insights

According to the debug.log file, the following error messages appeared repeatedly:

Error: Blockchain not found

Error: Invalid transaction

Error: Invalid header format

These errors indicate that Bitcoin Core 27 was unable to locate the blockchain or validate certain types of transactions. The “Blockchain not found” error is particularly concerning as it suggests a problem identifying the exact location of the blockchain.

Possible causes

Several factors could have contributed to these errors, including:

- Inconsistent network topology: Changes in network architecture or configuration could have disrupted the sync process.

- Invalid or corrupted transaction data: Malformed transactions or missing required fields can cause issues during validation.

- Incorrect block header format: The way blockchain blocks are formatted and validated can also affect sync performance.

Mitigation Strategies

To reduce the likelihood of these errors in future updates, the Bitcoin Core team has implemented various mitigation measures:

- Improved network detection algorithms

- Improved transaction validation mechanisms

- Increased block header validation

However, these efforts may not have resolved all of the underlying issues, and users are still encouraged to exercise caution when syncing their blockchain.

Conclusion

The discovery of 27 initial blockchain sync errors in Bitcoin Core 27 highlights the importance of monitoring and debugging during the sync process. By understanding what caused these errors and implementing mitigation measures in future updates, we can reduce the likelihood of such issues recurring.

Update Notes:

- Bitcoin Core 28 has been released with improved error handling and network detection algorithms.

- The debug.log file for Bitcoin Core 27 is now available on the GitHub page with a link to the original Reddit post.